Purchased Equipment on Account Journal Entry Equipment is the assets that company purchase for internal use with the purpose to support business activities. When you first buy new long-term equipment ie fixed assets it doesnt go on your income statement right away.

Undefined Principles Of Accounting Volume 1 Financial Accounting Openstax Cnx

Third to record the cash payment on the credit purchase of supplies.

. Accounts Payable Supply Company 165000. In accounting the company usually records the office supplies bought in as the asset as they are not being used yet. Accounting Your business purchased office supplies of 2500 on account.

Thus consuming supplies converts the supplies asset into an expense. 800 Accounts Payable Accounts Receivable OB. Likewise the office supplies used journal entry is usually made at the period end adjusting entry.

They are not for resale. Accounting questions and answers. They include the computer vehicle machinery and so on.

Instead record an asset purchase entry on your business balance sheet and cash flow statement. Despite the temptation to record supplies as an asset it is generally much easier to record supplies as an expense as soon as they are purchased in order to avoid tracking the amount and cost of supplies on hand. Credit Supplies O b.

Accounts Payable Supply Company 20000. The purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal entry. They include the computer vehicle machinery and so on.

Paid wages to its employees for the first two weeks of January aggregating 19100. Paid the accounts payable on the office supplies purchased on January 4. They are not for resale.

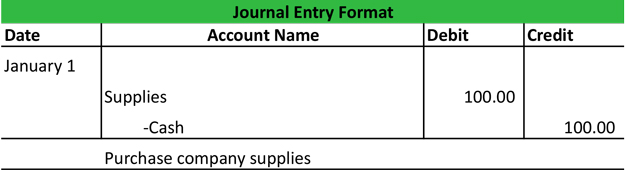

Accounting and journal entry for credit purchase includes 2 accounts Creditor and Purchase. 000 Accounts Payable Cash OC Cash Accounts. Accounting questions and answers.

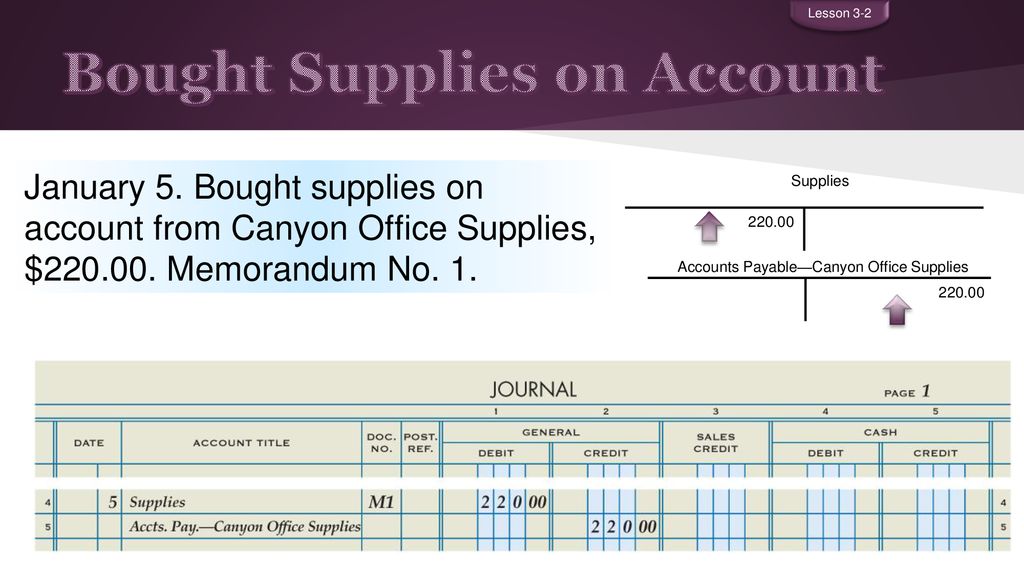

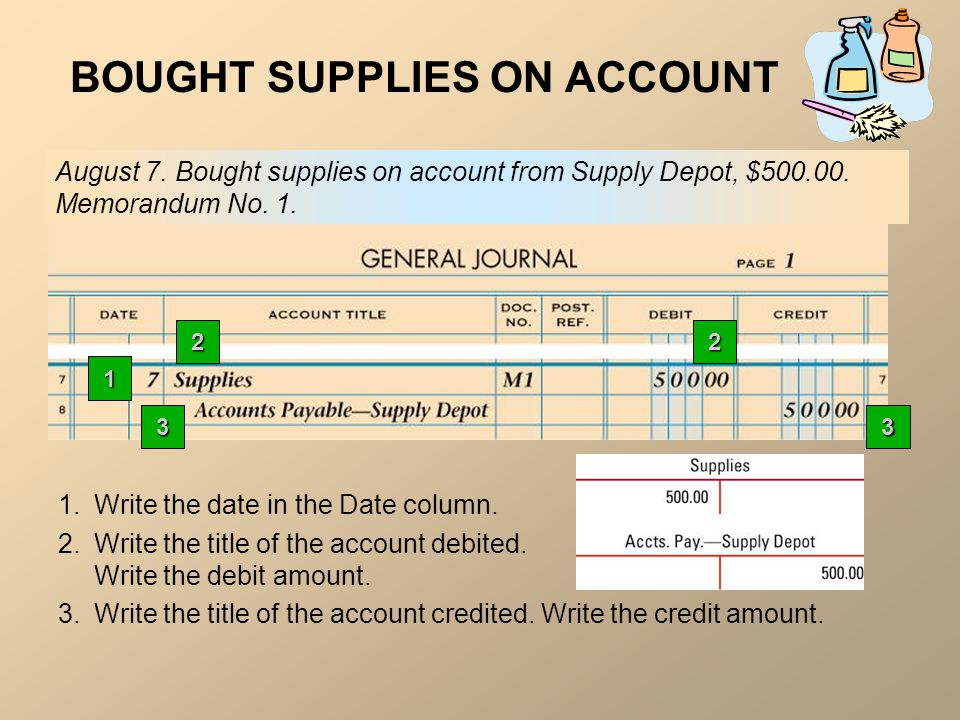

First to record the purchase of supplies on credit. The company purchased supplies which are assets to the business until used. Purchased supplies 750 on account.

What is correct Journal entry. Thus consuming supplies converts the supplies asset into an expense. Provided services to its customers and received 28500 in cash.

Assume the purchase occurred in a prior period Date Accounts and Explanation Debit Credit ОА. Second to record the return of supplies. Their accountant has set up a separate account for these kinds of purchases called Supplies Expenses.

Double-entry bookkeeping in accounting is a system of bookkeeping so named because every entry to an account requires a corresponding and opposite entry to a different account. Purchased office supplies costing 17600 on account. Office supplies used journal entry Overview.

On January 30 2019 purchases supplies on account for 500 payment due within three months. In this case the company ABC would make the journal entry of the purchase of supplies on March 19 2021 with the debit of office supplies account 3000 and the credit of accounts payable 3000. Provided 54100 worth of services to.

Bookkeeping Explained Debit The business has received consumable supplies paper towels cleaning products etc and holds these as a current asset as supplies on hand. Supplies is an asset that is increasing on the debit side. Example Journal Entry for Credit Purchase.

Third to record the cash payment on the credit purchase of supplies. The creditors account or account payable account will be credited in the books of accounts of the company. Purchased Equipment on Account Journal Entry Equipment is the assets that company purchase for internal use with the purpose to support business activities.

Credit Account Payable e. Related Topic Journal Entry for Credit Sales and Cash Sales Accounting and Journal Entry for Cash Purchase. Thus consuming supplies converts the supplies asset into an expense.

Purchase Credit Journal Entry is the journal entry passed by the company in the purchase journal of the date when the company purchases any inventory from the third party on the terms of credit where the purchases account will be debited. Journal entries are the way we capture the activity of our business. Record new equipment costs on your businesss balance sheet typically as Property plant and equipment PPE.

Purchase Credit Journal Entry is the journal entry passed by the company in the purchase journal of the date when the company purchases any inventory from the third party on the terms of credit where the purchases account will be debited. Only later did the company record them as expenses when they are used. Purchased supplies 750 on account.

Post a journal entry for Goods purchased for 5000 on credit from Mr Unreal. Which Journal entry records the payment on account of those office supplies. In accounting the company usually records the office supplies bought in as the asset as they are not being used yet.

Double-entry bookkeeping in accounting is a system of bookkeeping so named because every entry to an account requires a corresponding and opposite entry to a different accountThis lesson will cover how to create journal entries from business transactions. Gain on Asset Disposal. Also charging supplies to expense allows for the avoidance of the fees.

Later on March 26 2021 it makes the payments of 3000 to settle the credit purchase of supplies on March 19 2021. Accounts Payable Supply Company 185000. Cash Purchase on the other hand is simple and easy to account for.

JCC needs to purchase some basic supplies for use around the store such as pens printer paper and staples. Supplies is increasing because the company has more supplies than it did before. Purchasing new equipment can be a major decision for a company.

Sedlor Properties purchased office supplies on account for 800. Nothing to record c. Journal entries are the way we capture the activity of our business.

For the purpose of this journal entry example all compressors are entered into one entry. Purchased Equipment on Account Journal Entry.

Undefined Principles Of Accounting Volume 1 Financial Accounting Openstax Cnx

Undefined Principles Of Accounting Volume 1 Financial Accounting Openstax Cnx

Chapter Journal Review Ppt Download

Recording Purchase Of Office Supplies On Account Journal Entry

Paid Cash For Supplies Double Entry Bookkeeping

Unit 5 The General Journal Journalizing The Recording Process Ppt Download

Purchase Office Supplies On Account Double Entry Bookkeeping

Business Events Transaction Journal Entry Format My Accounting Course

0 comments

Post a Comment